LOYALTY MYTHBUSTERS: DON’T WORRY ABOUT POINTS LIABILITY

At the end of 2015, members of the American Airlines AAdvantage program had over 853 BILLION frequent flyer miles outstanding.

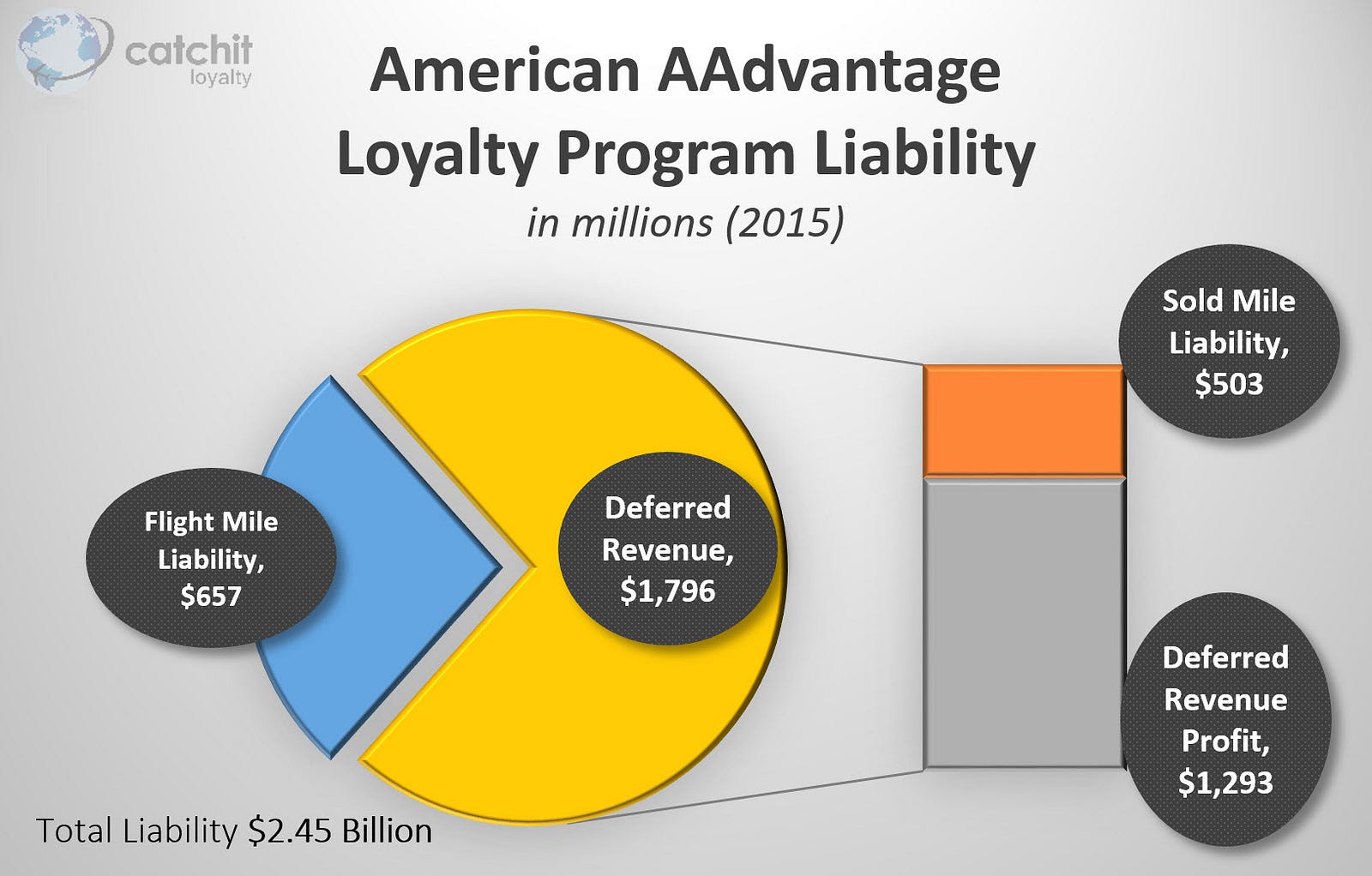

Those miles represented a total liability of around $2.45 billion.

Many folks see this “debt” as a threat to the viability of the airline and the frequent flyer program itself.

Even airline Chief Financial Officers are often fearful of members “cashing out” their miles too quickly.

U.S. based airlines typically don’t like to disclose the finances of their frequent flyer programs (FFP), often hiding behind the excuse that their credit-card and bank partners don’t want the details released. Other airlines operate their FFPs as separate entities and report more openly on the performance of their programs, to varying degrees.

This lack of disclosure makes it difficult to dispel myths about loyalty program liability.

Thanks to analysis by Catchit Loyalty, we can take a closer look at American Airlines and use the AAdvantage program as an example to illustrate – that far from being a “threat” to the airline – this program liability is actually a healthy sign of a highly successful cash-generative business unit.

In fact — the FFP is often an airline’s most valuable asset.

TWO TYPES OF MILES/POINTS

Before we analyze the loyalty program liability in more detail, it’s important to understand that there are two types of frequent flyer miles:

- The miles you earn when you take a flight. We call these “Flight Miles”; and

- The miles that an airline sells to third-parties such as banks, hotels and car rental companies. We call these “Sold Miles” or “Partner Miles”.

This video explains:

An airline can account for its mileage liability differently, depending on which set of accounting rules apply to it.

American Airlines accounts for these two types of miles differently.

FLIGHT MILES

If we take a look at the graphic at the top of this page, we can see that in 2015, American Airlines recorded a Flight Mile liability of $657 million.

The miles you earn from flying on American are accounted for under the “Incremental Cost” method.

American calculates this based on the estimated incremental cost of carrying one additional passenger. According to American Airlines:

“Incremental cost primarily includes unit costs incurred for fuel, food, and insurance as well as fees incurred when travel awards are redeemed on partner airlines. No profit or overhead margin is included in the accrual of incremental cost.”

Analysis by Catchit Loyalty reveals that in 2015, the incremental cost of a 25,000 mile award redemption was around $35.

Put another way — the average Cost-Per-Point was approximately $0.0014.

If your award flight was in Coach on American, the cost was even lower again. If you redeemed a First Class flight on a partner airline, the cost was higher.

This estimate is “breakage-adjusted”, meaning that it accounts for miles that are likely to expire without being redeemed.

“In calculating the liability, we estimate how many mileage credits will never be redeemed for travel and exclude those mileage credits from the estimate of the liability. Estimates are also made for the number of miles that will be used per award redemption and the number of travel awards that will be redeemed on partner airlines.”

SOLD MILES

American Airlines sold 182.7 billion miles to banks and other partners in 2015, generating an estimated $2.25 billion in revenue.

These miles were sold for approximately 1.2 cents each.

When miles are sold to third-parties, the revenue gets split into two components:

- MARKETING — according to American, this “represents services provided to our business partners and relates primarily to the use of the American brand including access to loyalty program member lists.” (The marketing component also covers lounge access and baggage services for co-brand cardholders); and

- TRANSPORTATION — according to American, “The transportation component represents the estimated selling price of future travel awards”, and is valued at “an amount significantly in excess of incremental cost.”

In 2015, the marketing component of mileage sales recognized at the time of sale, was approximately $1.5 billion, or around $0.008 per mile.

The transportation component is deferred and recorded in the liability as “Deferred Revenue”.

In 2015, American deferred approximately $750 million from the sale of mileage credits, or around $0.004 per mile.

If we take a look at the above graphic again — we can see that at the end of 2015, American had a Deferred Revenue balance of $1.796 billion.

IS IT REALLY A LIABILITY?

This is where it can get confusing for those without an accounting background.

As it happens, the deferred revenue component gets broken down into two more sub-sections:

- The $503 million actual “Sold Mile Liability”, which is what it actually costs American when those miles are redeemed; and

- The $1.293 billion “Deferred Revenue Profit”, which is the profit margin built-in to the “fair value” of the miles when they were deferred.

So that $2.45 billion liability that American had in 2015… really represents a cost of only $1.16 billion.

What happens to the other $1.293 billion..??..??

That revenue gets reported in American’s revenue figures when the miles are redeemed.

ACTUAL LIABILITY

It’s important to keep an eye on what the actual liability is for your loyalty program.

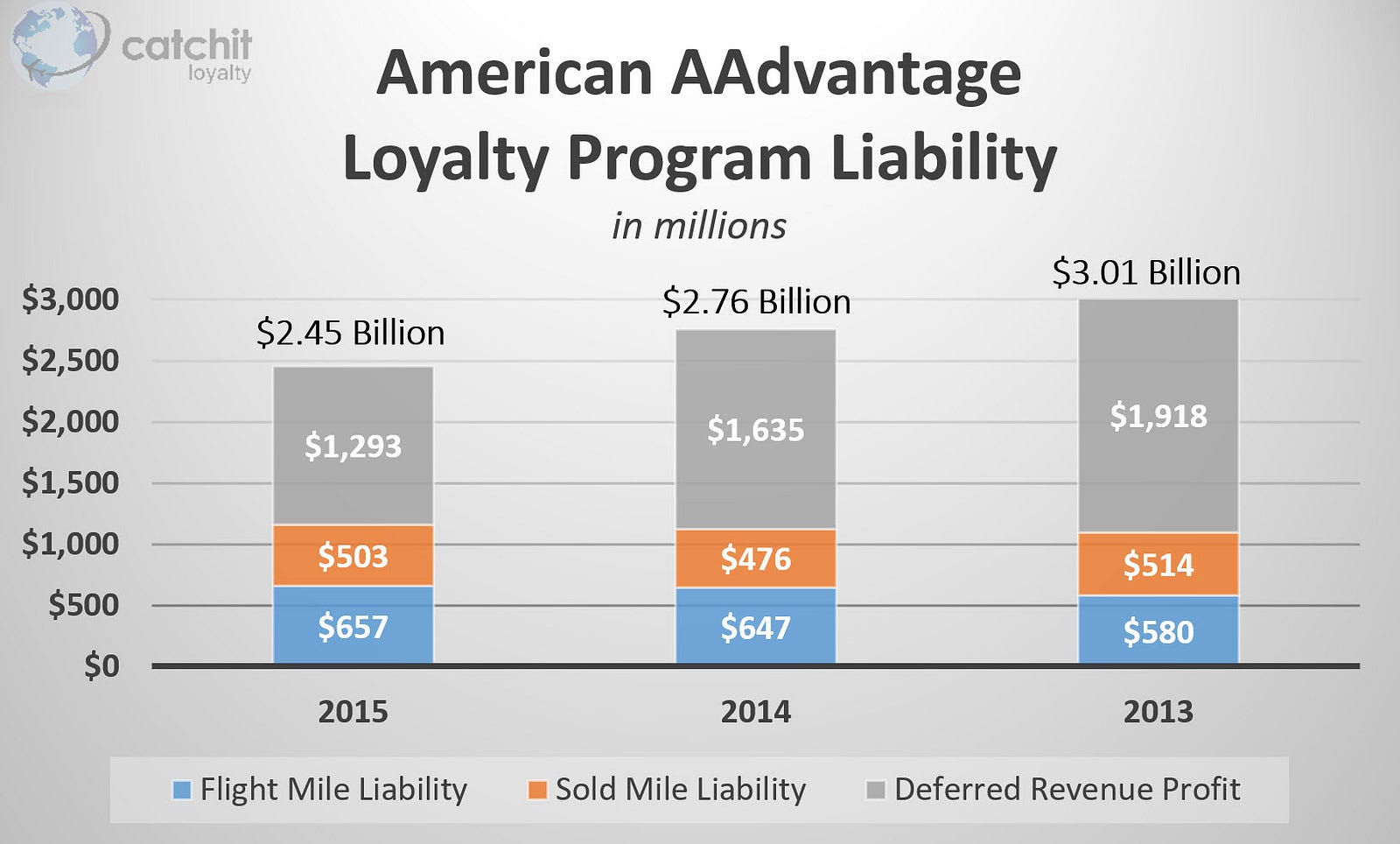

If we look at American’s liability for the years 2013–2015, we see that total liability decreased $559 million.

But if we look more closely, and add up the Flight Mile Liability and the Sold Mile Liability, we see that American’s real actual liability increased by $66 million.

ACCOUNTING MODELS

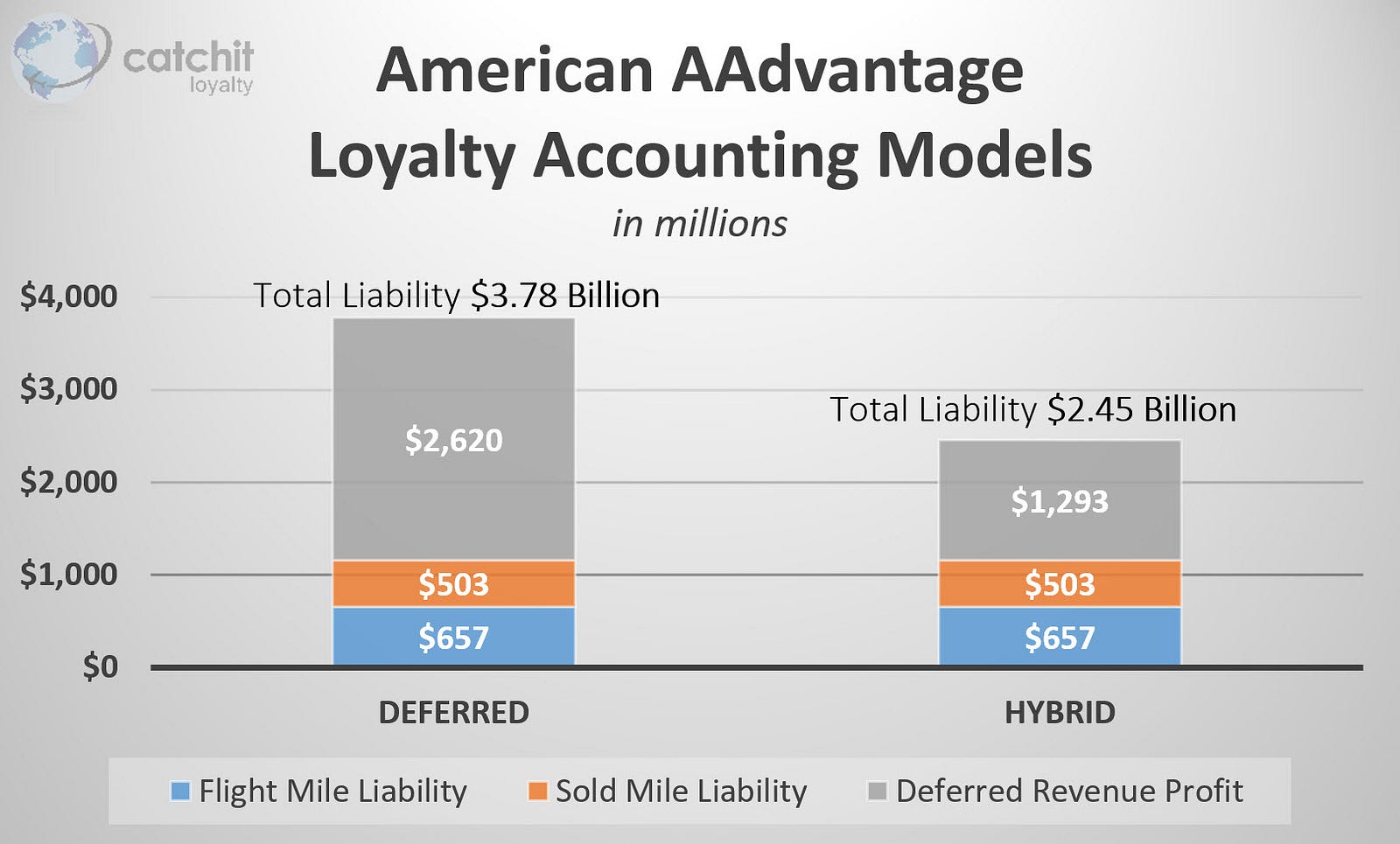

Different airlines account for their liability in different ways.

If we take our example of American Airlines, but revalue their flight mile liability from the “incremental cost method” to the “deferred revenue method”, we see that Total Liability would jump from $2.45 billion to a whopping $3.78 billion.

But if you look closely — you can see that the underlying true cost hasn’t changed at all.

Airline accounting is a complex beast, and this article is not intended as a lesson in accounting. Rather, it’s a basic overview of some of the issues involved, to help loyalty managers get a better grasp of the concepts around program liability.

CALCULATING LIABILITY ESTIMATES

As you can see from the above discussion, calculations of incremental cost and fair value require significant management judgement.

This is where detailed data analytics can drastically improve forecast accuracy.

American typically uses 12-month historical averages to estimate future redemption patterns, including allowing for enacted program changes and expected changes in member behavior.

Some of the questions that data can assist in modeling include:

- How many points are expected to be redeemed?

- How many awards will be in coach vs business or first class?

- How many awards will be redeemed on American vs partner airlines?

- How many awards will be redeemed on flights vs non-flight redemptions?

- What is the average member point-balance?

- What is the expected breakage (mileage-expiration rate)?

Additionally, members can earn points from multiple difference sources, often at different revenue/cost rates. For example, a member may have some points from flying, some from a credit card, and some from completing online surveys. The airline must factor this blend of miles into its economic forecasts and estimates.

Complex actuarial models are used to forecast program liability, and the more accurate your data — the more accurate your forecasts will be.

SUMMARY

Still confused?

Let’s put it this way — if everyone redeemed all of their American Airlines miles tomorrow — instead of making the airline bankrupt, the airline would successfully wipe its liability from the balance sheet, and in the process would also record a cool $1.293 billion in additional passenger revenue.

(Of course — in the real world, there are restrictions on that occurring, such as the availability of reward seats.)

But for an enlightened loyalty program, with an enlightened CFO, and a well-managed suite of low-cost redemptions (such as redeeming your Hilton points with Amazon), redemptions are nothing to fear.

They deliver both an uplift in loyalty, as well as positive financial results.

— — — — — — — — — — — —

As a publisher and global speaker on hotel & airline loyalty programs, David is focused on developing strategic solutions for loyalty programs, and is passionate about the critical link between loyalty strategy and the customer experience. David can be contacted here.

— — — — — — — — — — — —

More Articles by David Feldman:

THE PSYCHOLOGY OF BASIC ECONOMY

BAD DATA: WHEN BIG DATA GETS IT WRONG

DOES YOUR AIRLINE EVEN WANT YOU TO FLY THEM?

THE PSYCHOLOGY OF LOYALTY PROGRAMS

HOW THE SUCCESS OF FREQUENT FLYER PROGRAMS IS DRIVING AWAY LOYAL CUSTOMERS

HOW STARBUCKS BOTCHED ITS REWARD PROGRAM — Lessons for Loyalty Program Managers

WHY AMERICAN AIRLINES IS RISKING IT ALL WITH *CONFIRMED* CHANGES TO THE AADVANTAGE PROGRAM

— — — — — — — — — — — —

References and Further Reading:

- Catchit Loyalty analysis based on airline 10-K SEC filings, investor presentations, and discussions with airline executives

Disclaimer:

- Catchit Loyalty makes every effort to ensure the accuracy and quality of the information available in this article. Due to limited disclosure of program finances, significant estimations are included. Before relying on the information, readers should obtain any appropriate professional advice relevant to their particular circumstances. Catchit Loyalty can not guarantee, and assumes no legal liability or responsibility for the accuracy, currency or completeness of the information.

Source: LOYALTY MYTHBUSTERS: DON’T WORRY ABOUT POINTS LIABILITY